Product Description

The aim is to provide KGF guaranteed loan support to enterprises regardless of the sector through the Development and Investment Bank of Turkey.

Source for Guarantee

Treasury Fund

Related Financial Institutions / Corporations

Development and Investment Bank of Turkey Inc.

Product Maturity

Working Capital Loan: Maximum 5 years, including a maximum of 1 year principal grace period

Investment Loan: Maximum 10 years including a maximum of 3 years principal grace period

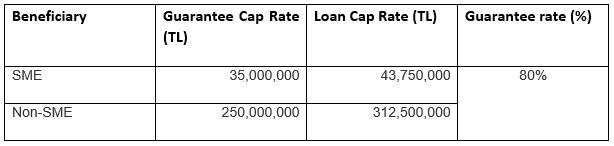

Guarantee Cap Rate and Guarantee Rates

Loan Products Available

- Cash loan / Non-cash loan

Fee and Commission

- In exchange for the guarantees used, KGF collects, through banks, 0.5% of the guarantee amount as a one-time upfront commission for each guarantee disbursement. If the maturity of the guarantee is less than one year, then the commission is applied proportionally to the quarterly maturities. If the guarantee maturity is less than one year, the commission is calculated and applied proportionally. In case of configuration, 0.5% of the amount of the guarantee balance will be collected from beneficiaries as upfront commission through banks.

- In exchange for the loan, the bank may collect from beneficiaries a maximum of 1% of the loan amount as a one-time upfront commission for each loan disbursement.

- In addition to the guarantee commission, the bank can collect the costs and commissions it pays to the loan funding institutions.

Special Conditions

- Within the scope of the TKYB Loan Support Package, the principal grace periods and maturities of the relevant financial institution can be taken as the basis for the loans financed by international financial institutions.