Product Description

This package is aimed at providing financing to SMEs and non-SMEs to cover investment and investment-related operating expenses related to energy efficiency and green transformation.

Resource for Guarantee

Treasury Fund

Related Financial Institutions / Corporations

Emlak Katılım Bankası, Garanti Bankası, Halkbank, İş Bankası, Kuveyt Türk Katılım Bankası, QNB Finansbank, Kalkınma Yatırım Bankası, Vakıfbank, Vakıf Katılım Bankası, Yapı Kredi Bankası, Ziraat Bankası, Ziraat Katılım

Product Maturity

Investment Loan -Maximum 120 months maturity (including the grace period)-Maximum 24 months grace period

Working Capital Loan - -Maximum 36 months maturity (including the grace period)-Maximum 6 months grace period

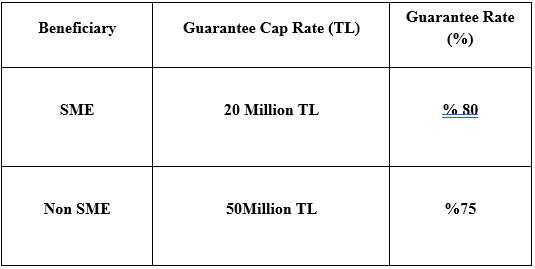

Guarantee Cap Rate and Guarantee Rates

Loan Products Available

- Business Credit Cards

- New Credit Card allocation

- Working capital loans that are to be disbursed to create a positive balance after making payments (including the following months) to a new Credit Card or existing Credit Cards that have no risk balance (Installment Loan, Spot Loan, Usury, etc.).

- Connected to a Debit/Bank Card;

- Overdraft Account (even if the beneficiary already has an account, a new overdraft account specific to this program must be opened)

- Installment Loan, Spot Loan, Usury, etc

- Working Capital Loan / Usury (*)

- Installment Loan

- Spot Loan

- Revolving Loan

- Cashless Overdraft Account products

- Other approaches suitable for Participation Banking

- Investment Loan (**)

- Installment Loan

- Other approaches suitable for Participation Banking including Finance Lease

(*)Participation Banks may disburse loans through appropriate methods for participation banking, regardless of Debit/Business Card

**This support package allows debtors who use investment loans under this package to access additional working capital loans not exceeding 10% of the respective investment loan, provided that the working capital loan is disbursed by the same creditor. In any case, the sum of the investment loans used and the operating loans cannot exceed 70% of the investment amount

Fee and Commission Rates

- The KGF shall collect, in return for each guarantee it gives, a one-time commission corresponding to 0.5% of the respective guarantee amount from the beneficiaries through the lenders. In the event of debt restructuring, a commission amounting to 0.5% of the balance amount of the guarantee shall be collected in advance from the beneficiaries through creditors.

- In retun for each loan disbursed, creditors may collect a commission amounting to a maximum of 1% of the loan amount from the beneficiaries.

Special Conditions

- Beneficiaries are required to commit to not reducing the number of employees for a period of two years from the date of loan disbursement.

- Credit cards will be restricted for cash advances.

- Enterprises that already hold or that have applied for an environmental label are required to submit certifying documents to creditors.

- Creditors will evaluate whether the submitted project is related to energy efficiency or whether it will have a positive environmental impact.

- Creditors may refer to the general framework described in the environmental label regulation for the evaluation of the positive environmental impact of projects submitted by enterprises that do not have, or that have not applied for an environmental label.

- For loans for energy performance contracts, a contract signed in accordance with the relevant legislation must be submitted to the creditor.

- The amount of an investment loan to be used under this package cannot exceed 70% of the investment amount planned or committed by the enterprise. If the beneficiary has an Investment Incentive Certificate (IIC), the amount of the investment loan cannot exceed 70% of the total investment indicated on the IIC.