- Home

- About Us

- Our Products

- KGF Equity Backed Guarantees

- Treasury Backed Guarantees

- ACTIVE SUPPORT PACKAGES(2023)

- EXPORT SUPPORT PACKAGE

- INVESTMENT SUPPORT PACKAGE

- SUPPORT PACKAGE FOR OPERATING EXPENSES

- INVESTMENT-PROJECT FINANCE SUPPORT PACKAGE

- MANUFACTURING INDUSTRY SUPPORT PACKAGE

- OPERATING EXPENSES SUPPORT PACKAGE FOR 6 FEBRUARY EARTHQUKES

- INVESTMENT SUPPORT PACKAGE FOR 6 FEBRUARY EARTHQUAKES

- SUPPORT PACKAGE FOR SEVERANCE PAYMENT OF RETIREMENT AGE VICTIMS

- REGIONAL SME SUPPORT

- SUPPORT PACKAGE FOR ACTIVITIES GENERATING FX-BASED INCOME

- SUPPORT PACKAGE FOR WOMEN ENTREPRENEURS

- ENTREPRENEUR SUPPORT PACKAGE

- SUPPORT PACKAGE FOR GREEN TRANSFORMATION AND ENERGY EFFICIENCY

- TECHNOLOGY SUPPORT PACKAGE

- SUPPORT PACKAGE FOR DIGITAL TRANSFORMATION

- EDUCATIONAL SUPPORT PACKAGE

- ACTIVE SUPPORT PACKAGES(2022)

- Other >

- Export Support Package

- Cold Air Units And Frigorific Vehicles Support Package

- Investment Support Package

- Additional Employment Support Package

- Manufacturing Based Import Substitution Support Package

- (KOBI DEGER LOANS)

- Treasury Fund (32,5 Billion TL)

- Treasury Fund (52,5 Billion TL)

- Treasury Fund (200 Billion TL)

- EKONOMI DEGER LOANS

- (KOBI DEGER LOANS II)

- TOBB NEFES LOAN 2020 SUPPORT

- ACTIVE SUPPORT PACKAGES(2023)

- Our Supports

- Information Center

- Press

- Contact Us

WHAT IS KGF?

KGF acts as a guarantor for SMEs and non-SME enterprises that cannot get a loan due to insufficient collateral. KGF supports SMEs and non-SME enterprises in access to financing.

ADDITIONAL EMPLOYMENT SUPPORT PACKAGE

Product Description

The aim is to provide financing to private sector enterprises, registered under Law No. 5510 and with less than 50 insured employees reported to the Social Security Institution for March 2021 for the withholding tax and premium service statements, to be used for their contractual or invoice-related operating expenses.

Source for Guarantee

Treasury Fund

Related Financial Institutions / Corporations

Ziraat Bankası, Vakıfbank, Halk Bankası, Ziraat Katılım Bankası, Vakıf Katılım Bankası

Product Maturity

Maximum 26 months (including the grace period) with a maximum of 8 months of no principal payment and a maximum interest-free period of 14 months

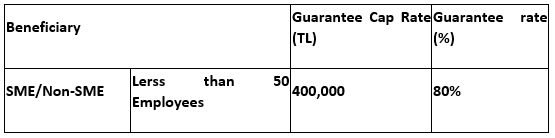

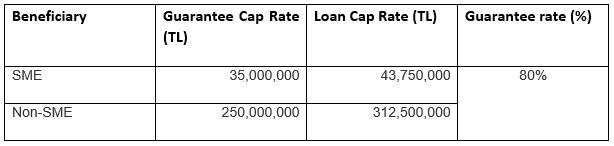

Guarantee Cap Rate and Guarantee Rates

Loan Products Available

Cash Loan with Instalments/ Murabaha Products

Loan Interest Rates for Beneficiaries

Cash Loan with Instalments/ Murabaha Products

Fee and Commission

- In exchange for the guarantees used, KGF collects, through lenders, 0.5% of the guarantee amount as a one-time upfront commission for each guarantee disbursement. In the case of configuration, 0.5% of the amount of the guarantee balance will be collected from beneficiaries as upfront commission through lenders.

- In exchange for the loan, the lender may collect from beneficiaries a maximum of 0.75% of the loan amount as upfront commission for each loan disbursement.

Special Conditions

- Maximum 26 months (including the grace period)

- Maximum first 8 months of no principal payment and maximum first 14 months interest-free period

- This guarantee can be used by private sector businesses, registered under Law No. 5510 and with less than 50 insured employees reported to the Social Security Institution for March 2021 for the withholding tax and premium service statements, for their contractual or invoice-related operating expenses.

- The beneficiaries must commit the following: that the additional employment is added to the average number of insured in the monthly premium and service documents or the number of insured in the monthly premium and service documents declared by the workplace employing them in the calendar year before their year of employment between 1/7/2021 and 30/06/2022 as per clause (a) of paragraph 1 of Article 4 of Law No. 5510; that they return the employee who benefited from cash wage support for at least 20 days in March 2021 to normal work and that they pay the premiums of this employee within the legal period for 12 months. If the employees return to the normal weekly working period before 1/7/2021, the start of the 12 months for these insured people will be from July 2021 onwards.

- Each beneficiary can benefit from the guarantee for a maximum of 5 additional employees.

- Each beneficiary will be able to benefit from a maximum guarantee of 400,000 TL with a maximum of 80,000 TL for each additional employee.

- All expenses will be documented by contract or invoice.

TURWIB PROGRAM SUPPORT PACKAGE

Product Description

About the funding provided by the European Bank for Reconstruction and Development (EBRD), the aim is to provide support to enterprises with female managers within the TURWIB program's scope and encourage greater participation of women in business life.

Source for Guarantee

Treasury Fund

Related Financial Institutions / Corporations

Akbank, Denizbank A.Ş., QNB Finansbank, TEB, Türkiye İş Bankası, Yapı ve Kredi Bankası A.Ş.

Product Maturity

Working Capital Loans: Maximum 60 months, including a maximum of 12 months grace period

Investment Loans: Maximum 120 months, including a maximum of 36 months grace period

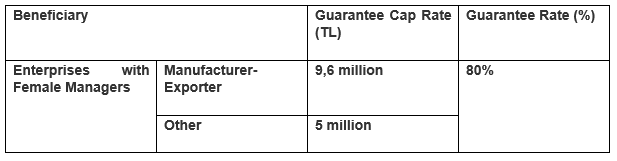

Guarantee Cap Rate and Guarantee Rates

Loan Products Available

- Cash loan / Non-cash loan

Loan Interest Rates for Beneficiaries

Cash Loan with Instalments/ Murabaha Products

Fee and Commission

-

In exchange for the guarantees used, KGF collects, through banks, 1% of the guarantee amount as a one-time upfront commission for each guarantee disbursement. In case of configuration, 1% of the amount of the guarantee balance will be collected from beneficiaries as upfront commission through banks.

Special Conditions

- Due to the implementation conditions of the TURWIB program, loans will not be available to companies that have partnerships with institutions owned by the Republic of Türkiye with a share of 49% and above.

- Within the scope of the TURWIB program, only SME-scale companies can benefit from loan disbursement.

TKYB LOAN SUPPORT PACKAGE

Product Description

The aim is to provide KGF guaranteed loan support to enterprises regardless of the sector through the Development and Investment Bank of Turkey.

Source for Guarantee

Treasury Fund

Related Financial Institutions / Corporations

Development and Investment Bank of Turkey Inc.

Product Maturity

Working Capital Loan: Maximum 5 years, including a maximum of 1 year principal grace period

Investment Loan: Maximum 10 years including a maximum of 3 years principal grace period

Guarantee Cap Rate and Guarantee Rates

Loan Products Available

- Cash loan / Non-cash loan

Fee and Commission

- In exchange for the guarantees used, KGF collects, through banks, 0.5% of the guarantee amount as a one-time upfront commission for each guarantee disbursement. If the maturity of the guarantee is less than one year, then the commission is applied proportionally to the quarterly maturities. If the guarantee maturity is less than one year, the commission is calculated and applied proportionally. In case of configuration, 0.5% of the amount of the guarantee balance will be collected from beneficiaries as upfront commission through banks.

- In exchange for the loan, the bank may collect from beneficiaries a maximum of 1% of the loan amount as a one-time upfront commission for each loan disbursement.

- In addition to the guarantee commission, the bank can collect the costs and commissions it pays to the loan funding institutions.

Special Conditions

- Within the scope of the TKYB Loan Support Package, the principal grace periods and maturities of the relevant financial institution can be taken as the basis for the loans financed by international financial institutions.